Discount bond formula

Discount Bond 60 950 632. Company 1 issues a bond with a principal of 1000 paying interest at a rate of 5 annually with a maturity date in 20 years and a discount rate of 4.

Bond With James Teaching Chemistry Chemistry Lesson Plans Physical Science High School

If a bond is trading at par the current yield is equal to the stated coupon rate thus the current yield on the par bond is 6.

. The accrued interest formula is. The current yield of a discount bond A Discount Bond A discount bond is one that is issued. The value of an asset is the present value of its cash flows.

Market Rate or Discount Rate - The market rate is the yield that could otherwise be received by buying another investment. The coupon rate is 7 so the bond will pay 7 of the 1000 face value in interest every year or 70. F rPY ETP Where.

R Coupon. In finance and investing the dividend discount model DDM is a method of valuing the price of a companys stock based on the fact that its stock is worth the sum of all of its future dividend payments discounted back to their present value. To understand why a bond with a coupon rate equal to the market interest rate is priced at par consider the following examples.

F Face value of the bond. The bond pricing calculator shows the price of a bond from coupon rate market rate and present value of payouts. The amount by which the market price of a bond is lower than its principal amount due at maturity.

The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity. Example of Zero Coupon Bond Formula with Rate Changes. The market interest rate is 6.

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor for a defined period of time in exchange for a charge or fee. The term discount bond is used to reference how it is sold originally at a discount from its face value instead of standard pricing with periodic dividend payments as seen otherwise. The company will raise funds for its upcoming capex plans by issuing these 10000 deep discount bonds.

Consider a bond with a 5-year maturity and a coupon rate of 5. Read more is basically. The yield to maturity YTM refers to the rate of interest used to discount future cash flows.

To find the bonds present value we add the present value of the coupon payments and the present value of the bonds face value. A 6 year bond was originally issued one year ago with a face value of 100 and a rate of 6. Read more fluctuate and prices increasedecrease as per the required rate of return of the investors.

Value of bond present value of coupon payments present value of face value Value of bond 9293 88849 Value of bond 98142. This amount called its par value is often 1000. Relevance and Uses of Discount Rate Formula.

Discount Rate Future Cash Flow Present Value 1n 1. This transaction is based on the fact that most people prefer current interest to delayed interest. Excel Formula Training.

As bond prices are quoted as. Bond Formula Example 1. Finally the required rate of return discount rate is assumed to be 8.

The yield to maturity YTM refers to the rate of interest used to discount future cash flows. A bonds coupon rate is the rate of interest paid by the bond issuers on the bonds face value. The coupon is paid semi-annually.

In other words DDM is used to value stocks based on the net present value of the future dividendsThe constant-growth form of the DDM is. The current yield on a bond depicts the annual coupon as a percentage of the market price which could be higher or lower than par. Essentially the party that owes money in the present purchases the right to delay the payment until some future date.

A natural question one would ask is what does this tell me. Let us take the example of deep discount bonds issued by ASD Inc. Formula to Calculate Bond Price.

In the example shown we have a 3-year bond with a face value of 1000. Finally the formula for discount rate can be derived by dividing the future cash flow step 1 by its present value step 2 which is then raised to the reciprocal of the number of years step 3 and the minus one as shown below.

Degrees Of Unsaturation Or Ihd Index Of Hydrogen Deficiency Chemistry Index Organic Chemistry

Bond Price Calculator Online Financial Calculator To Calculate Pricing Valuation Of Bond Based Financial Calculator Financial Calculators Price Calculator

Semiannual Coupon Bond Valuation Mgt232 Lecture In Hindi Urdu 10 Youtube Lecture Business Finance Bond

Drawing Line Structures In Organic Chemistry Organic Chemistry Chemistry Structural Formula

Excel Formulas For Accounting And Finance Basic Excel Tutorial Excel Formula Accounting And Finance Excel Tutorials

Covalent Bonds Types Of Chemical Formulas For Dummies Covalent Bonding Chemistry Gifts Chemical Bond

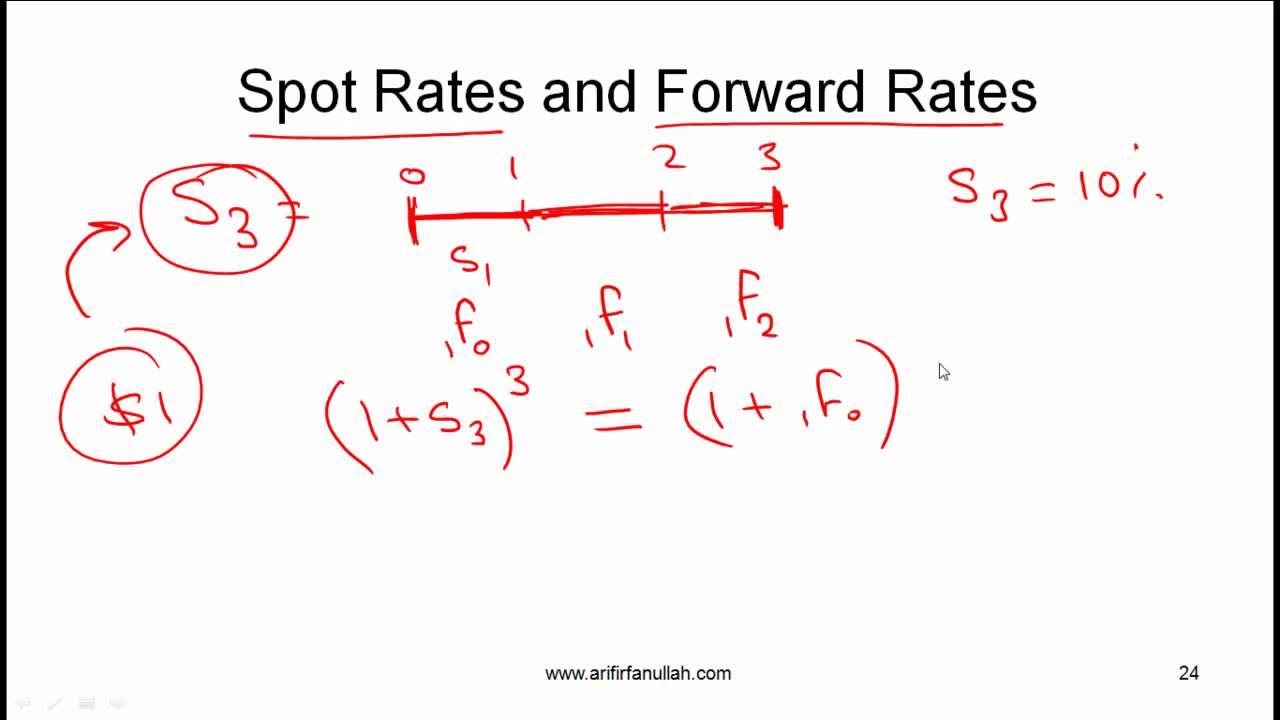

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

Simple Formula To Calculate The Number Of Phosphodiester Bond In A Dna Molecule Dna Molecule Molecules Biology Notes

Naming An Alkyne With A Double Bond When Directions Give Different Numbers Alphabet Writing First They Came Problem Solving

Taxable Corporate Bonds Vs Municipal Bonds Tax Exempt Non Taxable After Tax Equivalent Formula Corporate Bonds Bond Corporate

How To Calculate The Yield Of A Zero Coupon Bond Using Forward Rates Bond Calculator Really Cool Stuff

Cfa Level Ii Formulas Hardest To Remember Accounting Education Accounting And Finance Accounting Career

Here Is What I Ve Been Compiling As The Hardest To Learn Formulas For The Memorization Phase Not Surprising How To Memorize Things Formula Forensic Accounting

1 Chapter 6 Inorganic And Organic Compounds Names And Formulas 6 5 Covalent Compounds And Their Nam How To Memorize Things Covalent Bonding Structural Formula

How To Calculate Effective Interest Rate On Bonds Using Excel In 2022 Excel Bond Interest Rates

Drawing Dot Cross Diagrams Chemistry Class Structural Formula Covalent Bonding